Abstract

The EU emissions trading system (EU ETS) is the system the EU has set up to reduce greenhouse gas (GHG) emissions in Europe. As described in this article, the citizens’ initiative 100TWh found evidences that EU ETS didn’t achieve its objectives, and will never do.

But we also demonstrate that this is a pernicious system because despite its noble intentions, in reality it is a system that gives polluting rights to the wealthiest carbon emitting industries or States.

In particular, the ETS is used by some Member States to foster the building of new fossil based power plants to phase out carbon free nuclear installations having a potential for long term operation. This also shows the pernicious effect of the ETS when misused by politics.

For those reasons and the other described in our article, 100TWh plead for the abandonment of this EU ETS and for its replacement by an effective limitation of the greenhouse gas emissions.

ETS versus Nuclear

@ 100TWh

The EU emissions trading system (EU ETS) is the system the EU Commission has set up to reduce greenhouse gas (GHG) emissions in Europe. Nowadays it is used by some ecologists to justify the phasing out of the production of electricity by nuclear energy in Europe.

For the average European citizens, this sounds very strange because nuclear energy is already nearly carbon-free, and as such, it should be promoted by the EU Commission. Instead of that, nuclear energy has been excluded from the list of green technologies accepted by the EU Green Deal, the well-known “taxonomy”.

In reality, 100TWh found that nuclear energy is so clean that it puts the EU ETS at risk.

What is ETS?

First, let’s try to understand what is ETS?

According to the European Commission it is an virtual market created to reduce greenhouse gas emissions1: “The EU emissions trading system (EU ETS) is a cornerstone of the EU’s policy to combat climate change and its key tool for reducing greenhouse gas emissions cost-effectively”.

It has been imposed to 11,000 industrial companies, “heavy energy-using installations (power stations & industrial plants) and airlines”, to force them to limit their emissions.

How does it work?

The EU ETS works on the ‘cap and trade’ principle. The Commission establishes a “cap”, which is “the total amount of certain greenhouse gases that can be emitted by installations covered by the system”, and companies subject to the system “receive or buy emission allowances, which they can trade with one another as needed. They can also buy limited amounts of international credits from emission-saving projects around the world”.

According to an insider, this ETS system was once in competition with the carbon tax mechanism. But the EU succeeded to impose its ETS market mechanism, arguing the extraordinary outcomes of a similar system in reducing the SO₂ emissions in the US. By referring to the USA, two mistakes have been done. Firstly, USA is one country, with one enforcing law, with one environmental agency; there is no escape route if companies do not match goals. Secondly, while there are efficient industrial solutions to reduce SO₂, there is no such technology for CO₂. Controlling SO₂ emission is possible, controlling CO₂ emissions at affordable cost is not possible.. .

In the EU, electricity production from wind turbines and solar panels receive EU Allowances (EUA) that can be sold. On a global scale, projects that aim to reduce GHG receive credits that can be sold to European companies. Those “international credits are generated through two mechanisms set up under the Kyoto Protocol (…) : Clean Development Mechanism (CDM) or Joint Implementation (JI).”

The intention was to push industries to reduce their GHG emissions to avoid fines and, on the other hand, to promote the installation of wind turbines and solar panels and to develop less polluting projects outside EU. Curiously, although less carbonised than wind or sun, nuclear power did not benefit ETS allowances.

Real life examples

In a cement kiln the production of 1 ton of cement emits 1 ton of CO₂. Given the quota received, to increase its production a cement producer will have to buy EUA’s to a company which has an excess of it. The price of these allowances varies continuously as it is established by auction : in August 2018, it was 18.50 €/tonne of CO₂. If he doesn’t buy EUA’s, he will pay a fine of 100 € per new produced ton. Is this an incentive for European companies to invest in the future?

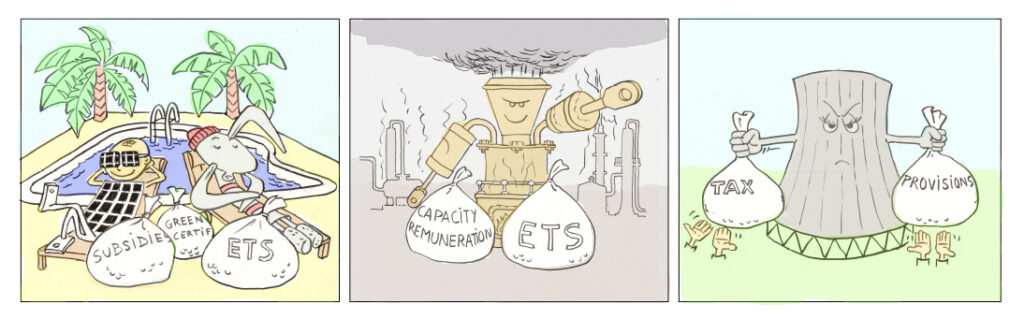

On the seller side, an electricity producer which operates intermittent wind mills or solar panels receives EUA’s based on the average efficiency of the 10% best installations in the “power generating sector”. It means that above the generous subsidieshe receives from the State (around 140 €/MWh in Belgium, see coming paper form 100TWh), he also receives a lot of allowances, he can sell to build gas power plants. Running intermittent renewables is thus a very profitable business ! That is the reason why 100TWh asks to stop subsidising it with tax-payer money.

Next to the normal working conditions of this market system, the ETS allows polluting companies to continue their business, if they can afford to pay for it…

Firstly, thanks to this system, polluting companies can easily “buy a green image”. An electricity seller who does not have sustainable production means can buy allowances from foreign renewable energy producers. With these certificates of origin, he can claim to provide green electricity, even though he knows that his country’s electricity mix is the same for every customer. Belgian citizens thinking that they buy green electricity are just paying for a virtual certificate, their electricity is not greener than the one of their neighbours who don’t pay for it.

Secondly, the ETS gives the right to the wealthiest countries to increase their pollution. If a rich country – like Belgium – replaces its carbon-free nuclear power plants with gas power plants, it can affor to buy allowances from another country, for example Poland, which replaces coal (>1000 gr CO₂/kWh) with gas (490 gr CO₂/kWh). The overall balance for Europe is that there is no CO₂ gain, but also no reduction: Belgium unnecessarily emits more CO₂ while Poland is making true efforts to reduce its emissions… This is why Poland introduced a claim against Belgium.

Has ETS been successful?

The European Commission claims that “emissions from installations covered by the ETS declined by about 35% between 2005 and 2019”.

But according to the Corporate Europe Observatory (CEO), a research group working to expose the privileged access and influence enjoyed by corporations and lobbies in EU policy making, this isn’t true2: “The ETS has not substantially reduced emissions”.

100TWh also defends that the worldwide reduction of greenhouse gas emissions of the last decade was primarily caused by the subprimes crisis of 2008, not by the ETS implemented by the EU Commission.

ETS evolutions

According to Clean Energy Wire3, “In the first two trading periods (2005-2007 and 2008-2012) the majority of allowances were given out for free and in generous amounts, so the price for first-period allowances fell to zero in 2007.”

After the reform, called the “third phase” covering 2013-2020, 40% of the allowances have been auctioned. However “free allocation” or “free allowances” still prevailed for manufacturing industry, the aviation sector and sectors deemed as exposed to “carbon leakage”, which means they are exposed to the competition from countries not supporting the ETS.

As a result, the prices of CO₂ allowances increased from 2.81 euros per tonne in early 2014, to 18.50 euros in August 2018. Yet according to the German Institute for Economic Research (Deutsches Institut für Wirtschaftsforschung, DIW), only a price of more than 40 euros per emitted tonne of CO₂ could make other energy sources more competitive than coal. Although never recognised officially by the EU Commission, this price of 40 euros is well known amongst the EU institutions and the lobbyists community.

In 2019, a market stability reserve (MSR) has been activated. This instrument allows authorities to adapt the number of CO₂-permits to regulate their price. In the EU jargon, allowances are put in a refrigerator to be used later when the price will be higher. This mechanism has been set up to neutralise the closing of CO₂ emitting installations without affecting the price of the allowances. So instead of rewarding the company or the state that reduces its emissions, the EU considers that nothing changed.

For 100TWh, ETS is becoming a real gas-works and we fear this will negatively impact the competitivity of the European industry.

ETS is a pernicious system

For 100TWh, the EU ETS not only didn’t achieve its objectives, but it is also a pernicious system because it is presented as a greenhouse gas reduction system, but in reality it is a system that gives polluting rights to carbon emitting industries.

Moreover, instead of combating climate change, ETS prevents effective carbon reduction to take place. As stated by the CEO, “The EU ETS is used to undermine other climate and emissions control policies”.

This can easily be understood, because for the EU Commission recognises that “The limit on the total number of allowances available ensures that they have a value”. This is a good reason to avoid that breaking technologies are developed to improve the energy efficiency or to decrease the greenhouse gas emissions too rapidly.

As demonstrated by CEO, “The ETS sets a ceiling on climate ambition”.

And what about the impact of ETS on developping countries?

According to the Centre for European Policy Studies (CEPS)4 “EU funding from the EU ETS for developing countries will send an important signal to developing countries”. But is it true? How can we be sure that those funds are not used to prevent or limit the economic development of those countries?

There are also two other problems related to the EU ETS, that have been highlighted by the CEO. Firstly “The EU ETS has not been cost-effective and has subsidised polluters at tax payers’ expense”. And secondly, because of the immaterial nature of commodity traded here “The ETS remains susceptible to fraud and gaming”. And indeed, we see an increasing number of ETS frauds arising nowadays.

ETS and Nuclear Energy

In contradiction to the general believe, renewables increase CO₂ emissions, so they do not comply with the intended goals to limit GHG.

This is due to the fact that new renewables will receive new allowance of ETS. This will increase the amount of ETS on the markets and thus decrease their market value. But at the same time, renewables will increase the CO₂ emissions because it will be necessary to burn gas in a back-up power plants to compensate their intermittence. This gas power plant will run 70% of the time, when there is no wind, or no sun. It must be noted that the installation of a new renewable plant will only be beneficial for the climate, if it is replacing an old fuel or coal fired power plant…

New nuclear plants will also increase the number of ETS on the market. Because those plants, that are built in replacement of coal or gas power plant, will be allowed large number of ETS inherited from the plants they replace. Putting these new ETS on the market increases the offer, thus decreases the ETS price.

Even worse, those nuclear power plants do not require to be associated to CO₂ emitting gas plants. As a result, the market demand for ETS will be reduced even further. So there will be no incentive anymore for polluting industries to cope with the European ambition.

And this is exactly the scenario that the EU Commission wants to avoid at all costs.

According to the CEO “Leaked UK government documents showed that (the Commission) sought to weaken energy efficiency measures and renewable energy targets on the grounds that these could collapse the carbon price. In another notorious case, the Commission’s Directorate-General (DG) on Climate Action warned against tougher energy efficiency measures for fear that these could collapse the carbon price”.

Unfortunately for the Commission, the scenario of a surplus of allowances already happened in 2015. Then, the Commission recognises to have acted on the ETS market to stabilise the ETS prices. This surplus was “largely due to the economic crisis (which reduced emissions more than anticipated) and high imports of international credits. This has led to lower carbon prices and thus a weaker incentive to reduce emissions”. As a result, “The surplus amounted (…) more than 2.1 billion in 2013”. In 2015, intervening directly in the ETS market, “the Commission postponed the auctioning of 900 million allowances until 2019-2020”, which reduced the total amount of allowances “to around 1.78 billion”.

Conclusion

For all the reasons above, the EU ETS should be abandoned, and replaced by an effective limitation of the greenhouse gas emissions. We agree with the Germany environmental lobby and ask our government “to rely less on the ETS and to step up efforts to reduce domestic CO₂ emissions [30]”.

If this pernicious system could be stopped, the nuclear energy would appear as one of the best solution to achieve the objectives of the European Green Deal.

1 see EU Commission at https://ec.europa.eu/clima/policies/ets_en [10]

2 see Corporate Europe Observatory (CEO) https://corporateeurope.org/en/environment/2015/10/eu-emissions-trading-5-reasons-scrap-ets [20]

3 see Clean Energy Wire at hhttps://www.cleanenergywire.org/factsheets/understanding-european-unions-emissions-trading-system#:~:text=The%20EU%20ETS%20follows%20a,and%20they%20can%20trade%20them. [30]

4 see Centre for European Policy Studies https://www.ceps.eu/wp-content/uploads/2009/07

/MainFindingsTFReviewEUETSversion20081124.pdf. [40]